In a few weeks, open enrollment will begin. I want to take this opportunity to provide some information on one of our often overlooked health care plans — the Savers Choice High-Deductible Health Plan (HDHP), the only plan with a health savings account (HSA). This plan has been offered since 2018, and currently, approximately 750 of our unit members are taking advantage of this plan.

Some of you may be like me. I chose the Cigna HMO plan when I began my career with the City and never explored any other options. It wasn’t until the City parted ways with Cigna that I was forced to do my research and consider my options. When I began looking at the plans offered by the City, my head began to spin. There were so many nuances that I wanted to just stop reading the benefits guide and stick with the new HMO, which would be my default if nothing else was selected

HSA is an account that is funded with pre-tax money that can be used to pay for qualified medical expenses.

Still, I was intrigued by the HSA. I had only heard of it in passing and had no clue what it was all about. I found that the HSA is an account that is funded with pre-tax money that can be used to pay for qualified medical expenses. I also heard that the City would make a deposit into that account every year just for simply being enrolled in the Savers Choice HDHP. Free money always seems like a win to me; however, I was still suspicious. Continuing my research, I found that the monthly premium for the HDHP was less than the other two plans. It is still a Blue Cross plan, which is the same provider and network as the PPO plan that everyone seemed very happy with. Now, remember, I have had an HMO from the beginning. The thought of yearly “deductibles” concerned me. For single coverage, it is $1,500, and for a family, it is $3,000. Here is the best part. Every January, the City will contribute to your HSA. Up until now, it has been exactly half of the yearly deductible. This coming January, that contribution has increased from $750 to $1,125 for single coverage and from $1,500 to $2,250 for family, which is 75% of your yearly deductible. So, your out-of-pocket dollars are reduced to $350 for single coverage and $750 for family. In addition, don’t forget the monthly premiums are the lowest out of all the plans, so there is a savings there as well. In addition, you can experience additional savings by completing the health risk assessment and receiving the wellness incentives.

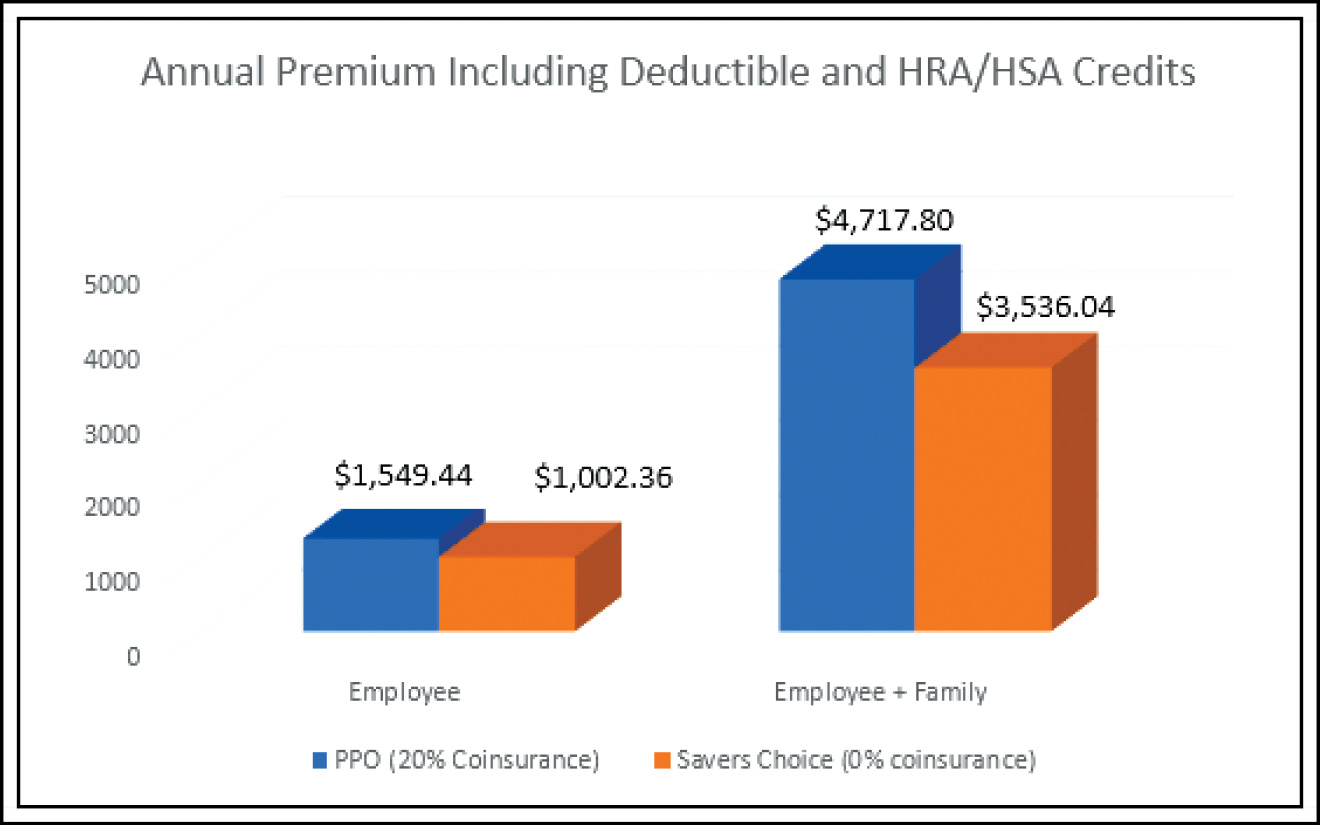

The chart depicts what your total would be if you were a regular to high utilizer of health benefits and met your annual deductible. Someone who uses health insurance for just the yearly physical or well check and nothing else would experience reduced out-of-pocket costs.

Here is the other perk. That HSA account is yours forever. This means that it rolls over year after year, unlike Flexrap, which is a use it or lose it. You can also defer some of your paycheck on a pre-tax basis into the account. IRS annual contribution limits are set for calendar year 2021 at $3,600 for single coverage and $7,200 for family coverage. The HSA funds can be used for a myriad of things, from medical, prescription drug, dental, vision and over-the-counter health expenses. There is an expansive list of approved expenses available online from Health Equity (our HSA administer) and #9695 IRS Publication 969. You could also choose to pay for all the expenses and co-pays out of pocket, which would allow this account to grow and be used when you retire to offset monthly health care premiums with pre-tax dollars. You could also reimburse yourself for IRS-qualified medical expenses with HSA funds at any time if the expenses were incurred after your HSA was established. There is no reimbursement deadline, but keep in mind, this requires a level of discipline to keep meticulous track of your receipts.

Now, I know many of you are wondering what the “downside” of the plan is. Before you meet your deductible, you will pay 100% of the medical and prescription costs. These are not retail costs, but the reduced agreed upon rates that were negotiated by Blue Cross. In addition, even after your reach the $1,500 or $3,000 deductible, the prescriptions continue to be a reduced retail rate until you reach the maximum annual out-of-pocket costs of $3,000 for a single plan or $6,000 for a family plan. You cannot be enrolled in other medical coverage or Medicare. You cannot be claimed as a dependent on someone else’s tax return. You cannot use HSA funds to pay for health care expenses incurred by a domestic partner.

Consider, however, after you reach your deductible, all doctor visits and procedures are covered at 100% for the remainder of the calendar year. All the same doctors and hospitals available to the PPO plan are available to the Savers Choice Plan. However, it is important to note that the Savers Choice HDHP does not have out-of-network coverage. Currently, the PPO is the only plan that provides out-of-network coverage; however, most providers in the Phoenix area are in-network, so very few utilize out-of-network benefits.

The bottom line is this — if you are a low utilizer of health insurance, other than the yearly well check, this is a great opportunity to build the HSA by deferring some of your earnings and lowering your tax liability. The unused funds continue to grow and earn interest over time, and once your account reaches $2,000, you have investment options. The interest earned on your HSA balance is untaxed. If you are a high utilizer of health insurance, this is also a great plan to consider. Remember, after the deductible is met, everything else, except prescriptions (unless you meet max out-of-pocket), are covered at 100%. It certainly deserves your consideration.

If you have questions about this or any other City-sponsored benefit plans, you can send an email to benefits.questions@phoenix.gov, or you can call the Benefits Office at (602) 262-4777 and ask to speak to a benefits analyst. You can review the current benefits guide online at phxbenefits.com.

I can be reached here at the PLEA office or via email at dkriplean@azplea.com.