The high cost of health insurance is one of the biggest considerations when making the retire-now or retire-in-the-future decision. I personally have been battling retiree health insurance costs for over 20 years, and I’ve learned two things: There is no one-size-fits-all option, and there is no permanent option. Every year, I consider my family’s needs and look at the available options. Then, I make the best decision for that year. The great news is that the options continue to expand, and some retirees receive no-cost or very low-cost quality health insurance.

The high cost of health insurance is one of the biggest considerations when making the retire-now or retire-in-the-future decision. I personally have been battling retiree health insurance costs for over 20 years, and I’ve learned two things: There is no one-size-fits-all option, and there is no permanent option. Every year, I consider my family’s needs and look at the available options. Then, I make the best decision for that year. The great news is that the options continue to expand, and some retirees receive no-cost or very low-cost quality health insurance.

Did I just grab your attention? I hope so. Every year I talk to people who have wanted to retire but haven’t because of the health insurance premium horror stories. Let me explain how I recommend controlling health care costs so you can make an informed, realistic decision.

First, prior to retirement, I usually recommend one enroll in the COP Blue Cross Blue Shield Saver’s Choice plan. My reasoning is this plan has significantly lower COBRA premium costs ($438 a month per individual), and remaining on COBRA through the year of retirement to take advantage of any deductibles spent makes sense. Then, during the annual open enrollment period, we get busy selecting and evaluating our options for the following year, armed with an accurate estimate of that year’s income.

First, prior to retirement, I usually recommend one enroll in the COP Blue Cross Blue Shield Saver’s Choice plan. My reasoning is this plan has significantly lower COBRA premium costs ($438 a month per individual), and remaining on COBRA through the year of retirement to take advantage of any deductibles spent makes sense. Then, during the annual open enrollment period, we get busy selecting and evaluating our options for the following year, armed with an accurate estimate of that year’s income.

We usually dismiss the COP and PSPRS health insurance options, as both are very expensive for the benefits offered except in unusual circumstances. Both options can have monthly premiums exceeding $1,000 a month per person. This year, we were fortunate to offer an additional option through the Thin Blue Line Benefits. This plan just became available in September 2022 and has lower premiums ($725 for individual and $1,280 for retiree and spouse) than the COP or PSPRS options. The plan includes a large national provider network and affordable co-pays and out-of-pocket limits. All the above options qualify a retiree for their full COP MERP benefit ($168 or $202 a month) and up to $260 premium benefit subsidy through PSPRS.

Now, consider the following: The average pension is approximately $75,000 a year. Under the Affordable Care Act, with the updated American Rescue Plan legislation, an individual enrolling in a health insurance plan through the federal marketplace will not pay more than 8.5% of their income toward health insurance. In the case of a $75,000-a-year pension, this amounts to paying no more than $6,375 a year for health insurance, regardless of how many individuals are enrolled. To determine the federal tax credit applied toward the plan premiums, one takes the difference between the 8.5% income threshold and the plan premium. The plan premium is determined by age and the second-lowest-cost silver level plan in a given county, regardless of the actual plan eventually selected for enrollment (usually a bronze-level plan).

This is how some individuals end up with a no-cost health insurance plan. Because plan premiums are based on age, older individuals receive a greater tax credit than younger retirees.

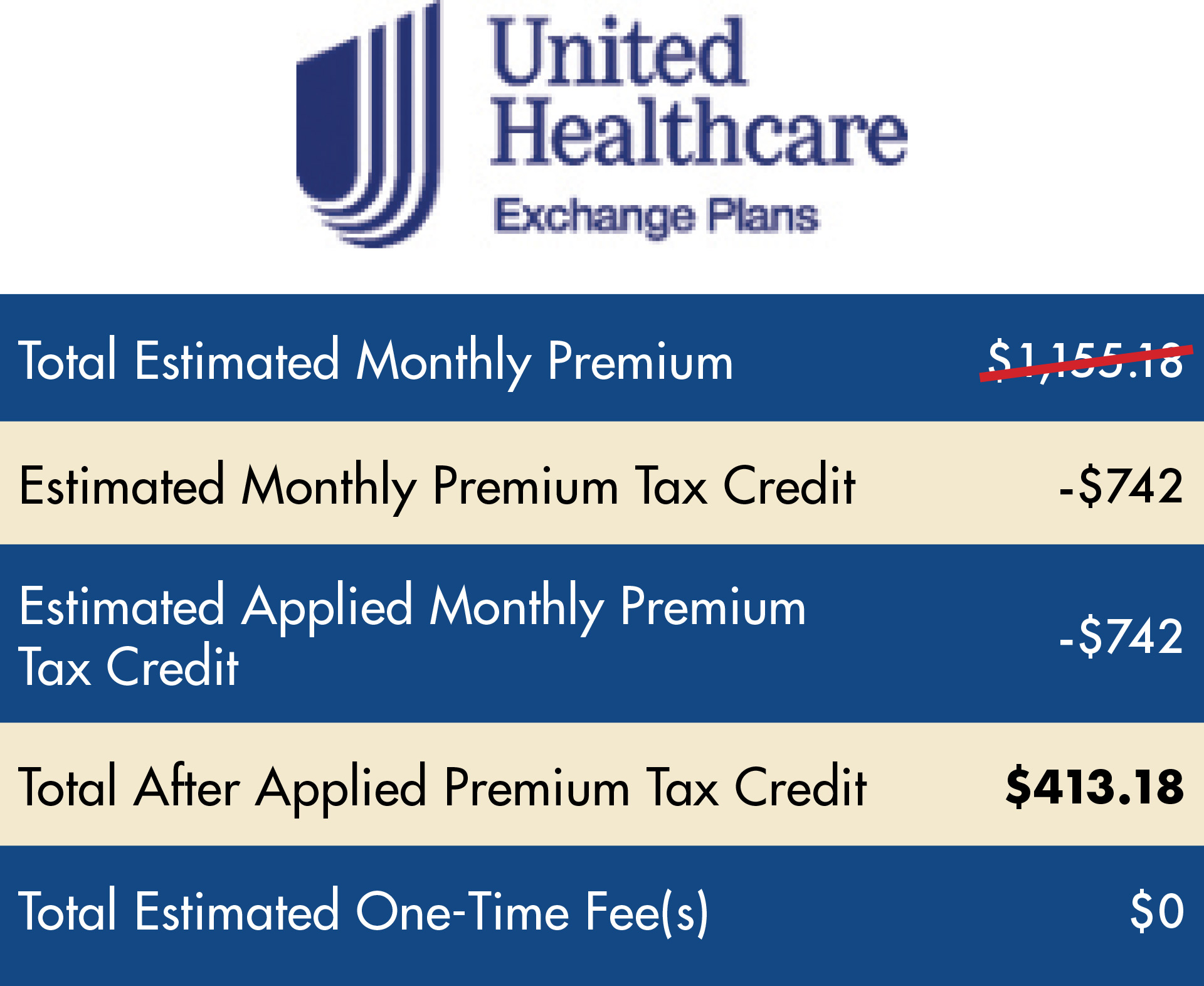

Using a real-life example, let’s assume my wife and I are each 58 years old. Together, our annual “pre-tax” income is $100,000, and we live in Maricopa County. Under this scenario, the federal government will pay directly to the health insurance carrier $742 a month for our insurance. In 2023, we have 137 plans from eight carriers from which to choose. I usually select one of the lower-cost options for many reasons, and in this case, an option from United Healthcare would have a monthly premium of $413 a month. That’s for both of us!

In the next example, let’s look at a 63-year-old single retiree with a $60,000 retirement. Under this scenario, the individual is eligible for a $416 federal tax credit to help pay for their federal marketplace insurance. This allows the individual to select the same plan as above. However, their costs would be $254 a month.

Under the Affordable Care Act rules, an individual is not permitted to receive their MERP or premium benefit subsidy to help pay for their federal marketplace plan premiums. Both of these benefits are not reported to the IRS, however, to be on the safe side, I suggest using the MERP to pay for dental and other non-covered health care costs and the premium benefit subsidy for supplemental insurance to help cover the actual out-of-pocket costs for the higher deductibles while enrolled in these plans. Allocating the $260 premium benefit subsidy toward critical illness insurance (cancer, heart attack, stroke, etc.) and an accident plan will provide additional financial protections to help pay for the higher out-of-pocket health care costs, with the subsidy reimbursing retirees for the supplement premiums. These products are similar to AFLAC, however, I prefer a United Healthcare-equivalent product that has a much better value with increased benefits for the money.

There is absolutely no cost for you to work with a broker such as myself to assist you with your health care decisions, and the premiums remain the same whether you enroll yourself or through a broker. Just make sure the individual is well-versed in how all of your COP benefits work, the paperwork required to legally obtain your premium benefit subsidy and how to help narrow down and select the appropriate health insurance plan based on your needs.

There is absolutely no cost for you to work with a broker such as myself to assist you with your health care decisions, and the premiums remain the same whether you enroll yourself or through a broker. Just make sure the individual is well-versed in how all of your COP benefits work, the paperwork required to legally obtain your premium benefit subsidy and how to help narrow down and select the appropriate health insurance plan based on your needs.

The decision to retire requires consideration of many factors, but remember, there are strategies you can use to minimize your health care costs. Maybe that is enough to tilt the decision one way or the other?

For more information about retiree health insurance options, scan the QR code above or visit tinyurl.com/2wwd6wr3.